Most of us think of profit as something earned from stocks or business deals—but saving money on a home loan can be just as rewarding.

Did you know that paying off your home loan early is a kind of financial profit too? It may not give you a monthly dividend, but the money you save on interest and the peace of mind you gain can be just as valuable. No matter if you’re in the early stages of your loan or halfway to the finish line, understanding the financial and emotional benefits of early repayment can reshape your long-term plans.

First, let’s talk numbers. Home loans often span 10 to 25 years and carry significant interest costs. Even a small extra payment each month or a one-time part-payment can reduce your total interest burden by lakhs of rupees. This is especially true in the early years when most of your EMI goes toward interest rather than the principal. So, every extra rupee paid now chips away at the interest mountain, saving you money in the long run.

Beyond the numbers, repaying your home loan early brings a sense of security. Imagine waking up one day and realizing that your biggest liability is gone. That freedom can allow you to redirect your income toward other life goals like travel, business, or your child’s education without the looming shadow of debt. It’s not just financial breathing room; it’s emotional relief.

There’s also a psychological boost that comes with early loan closure. Knowing that you’ve achieved a debt-free home ahead of schedule builds confidence in your financial discipline. It fosters a mindset of savings and smart money management. Plus, with fewer liabilities on record, your credit score may improve, making future financial approvals smoother.

In the end, repaying your home loan early isn’t just about closing an account, it’s about opening new possibilities. The “profit” you earn isn’t always seen in your bank balance. Sometimes, it’s felt in your daily peace of mind, in your freedom to dream bigger, and in the joy of knowing that your home truly belongs to you faster than planned.

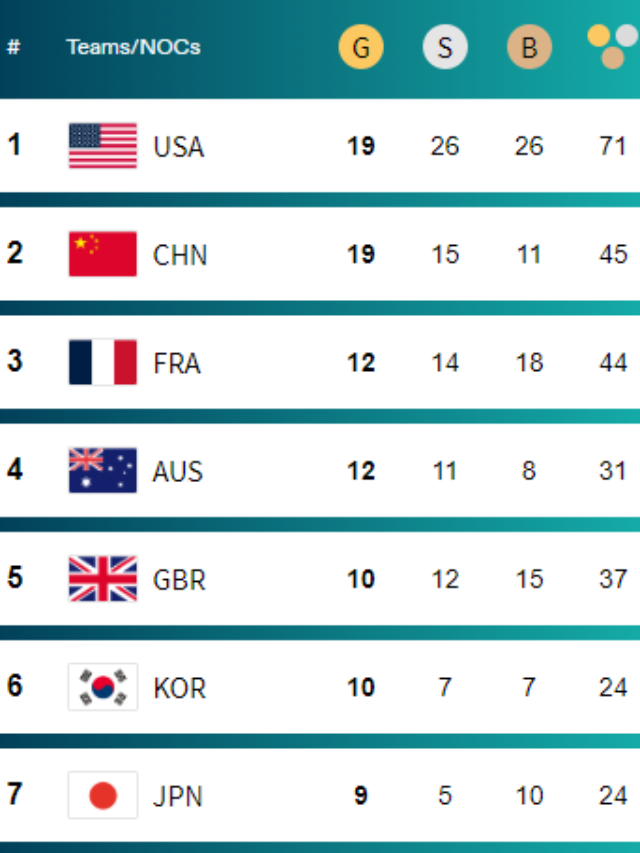

How does a home loan work?

| Month | EMI | Interest | Principal | Cumulative Principal | Equity % |

|---|---|---|---|---|---|

| 1 | 35000 | 32000 | 3000 | 3000 | 8% |

| 2 | 35000 | 31800 | 3200 | 6200 | 10% |

| … | … | … | … | … | … |

| 240 | 35000 | 500 | 34500 | Full loan repaid | 100% |

Calculating EMIs and Planning Finances

Part Payments to Lower Interest Rate Burden

Opting for Flexible EMI Options

Balancing Home Loan Repayments with Other Financial Goals

Refinancing Options for Lower Interest Rates

Making Use of Tax Benefits

🏁 Conclusion: Why This Matters for Homeowners:

Understanding how your EMI splits between interest and principal isn’t just financial trivia—it’s key to making smarter decisions about your home loan. In the early years, a significant portion of your EMI goes towards interest, meaning your actual ownership (equity) builds slowly. But over time, the tide shifts, and your equity begins to rise steeply.

In short, tracking your home equity growth alongside EMI structure empowers you to take control of your loan—and your wealth.

Please Note:

The views in the article /blog are personal and those of the author. The idea is to create awareness and not intended to provide any product recommendations.